Share This Post:

Image Credit: Yancy Min

The July ABI Scores In A Nutshell

July 2020 ABI Score

This is post 4 of 7 in the series ABI Monthly Updates

This is post 4 of 7 in the series

ABI Monthly Updates

WORLD NEWS | Carolyn Feinstein | August 26, 2020

WORLD NEWS | Carolyn Feinstein

August 26, 2020

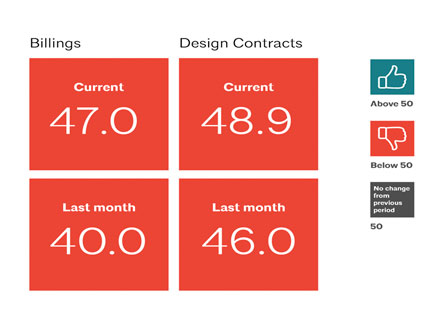

The Architectural Billing Index (ABI) for July 2020 has been released, and the data shows modest, but promising leveling off of the industry's previously declining numbers. As not to provide false hope, the numbers are still pretty dismal, but the fact that they are not continuing to slide downward could provide some hope that recovery has begun.

Image Credit: AIA

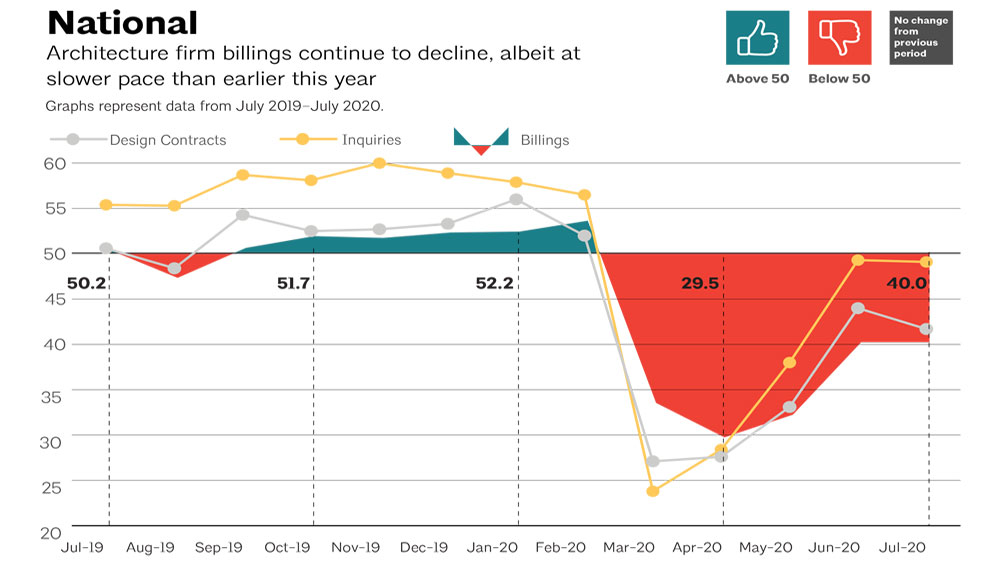

Nationwide, the ABI held at 40.0 for architecture firm billings, the same score as last month. Billings continued to decline, but a slower pace than the previous months of 2020. The rate of inquiries from new clients and restarted projects is holding steady as compared to June, but that is not necessarily good news when it comes to clients committing to moving forward. Design contracts fell from a June score of 44.0 to 41.7 in July. According to firms responding to the AIA's monthly special practice questions, inquiries are less frequently leading to signed contracts. This may be related to the increased cost of construction, stemming from COVID-19 precautions or concerns about future economic pressures.

Image Credit: AIA

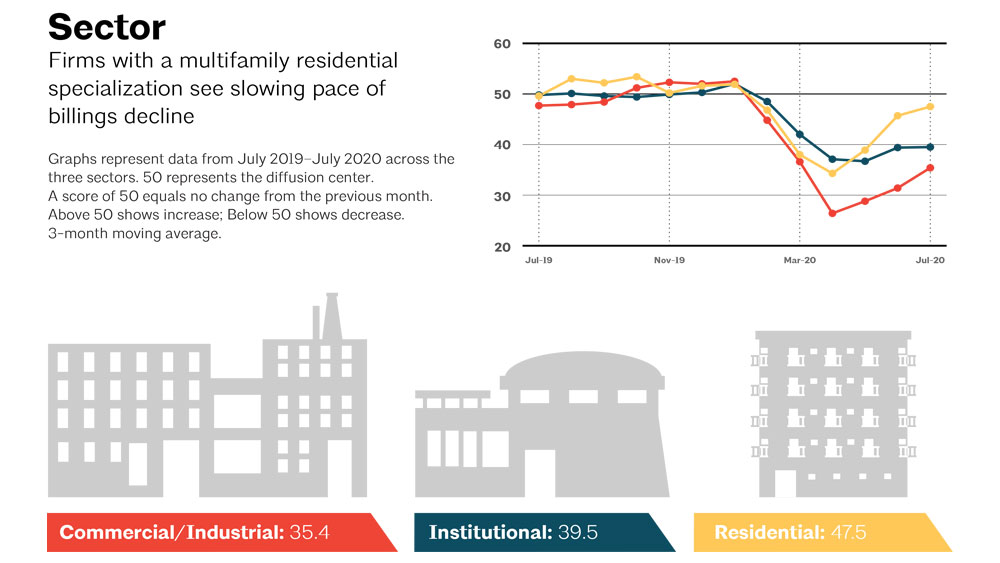

Just as we saw in last month's report, the multifamily housing sector seems to be experiencing the strongest performance in the industry, with a score of 47.5. Institutional and commercial/industrial specialization are still reflecting 35.4 and 39.5, respectively. To keep things in perspective, this is not actually a rosy picture as we are comparing who has the slowest rate of decline rather than the fastest growth.

Image Credit: AIA

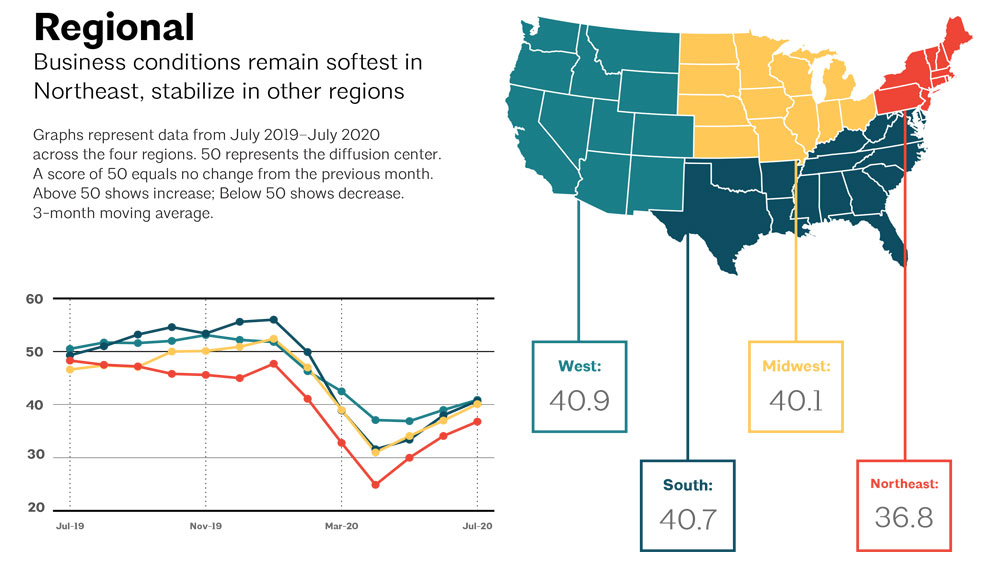

Regional scores are providing a positive outlook for July 2020 when compared to the previous month. The South and West regions boasted the highest scores of 40.9 and 40.7, respectively. This can be considered a solid gain from the 36.8 (West) and 35.9 (South) scores reported for June. The Midwest is also making a solid comeback with a 4 point increase from its June score of 36.8 to a score of 40.1 for July. Business conditions remain the softest in the Northeast, which trails the pack with a modest gain of fewer than 3 points in its' July score of 36.8.

Image Credit: AIA

Unfortunately, these soft business conditions have led more than 45% of the firms responding to the special practice questions to anticipate having to reduce hours, or eliminate staff, as the availability of funds for the Paycheck Protection Program (PPP) comes to a close. Of the respondents, 85% of firms received PPP funding, while 1% had denied applications, and the remaining 14% did not apply. From the responses, it seems as though the smaller the firm, the less likely they are to expect to have to make staffing changes.

Overall, the data provided in the July ABI can be taken as a positive sign that the decline is leveling off, or a cautious reminder that the industry remains soft at present. Although clients seem to have reservations about signing contracts, the increasing stream of inquiries is a welcomed reminder there is a very real demand for architectural services.