Share This Post:

Image Credit: Francis Scialabba

October 2020 ABI Score

October 2020 ABI Score

This is post 1 of 7 in the series ABI Monthly Updates

This is post 1 of 7 in the series

ABI Monthly Updates

WORLD NEWS | Carolyn Feinstein | December 07, 2020

WORLD NEWS | Carolyn Feinstein

December 07, 2020

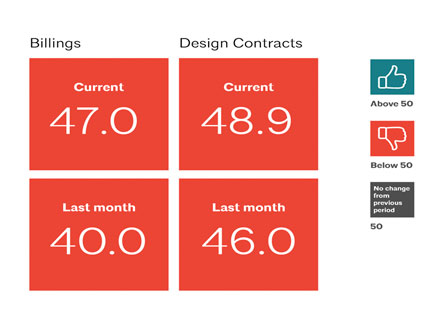

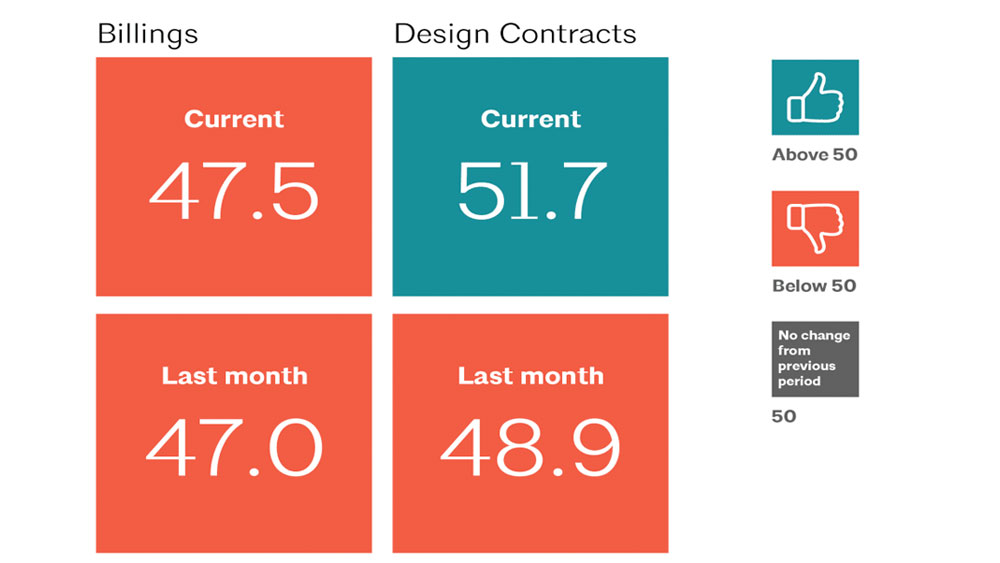

The Architectural Billings Index (ABI), the economic indicator by which we in the architecture industry monitor the business outlook for the coming months, has released the October 2020 report. Although the movement is sluggish, the indicators are trending toward the positive. The billings index remained below the breakeven level of 50, yet design contracts have broken through the barrier with a positive index of 51.7 for the month.

Image Credit: AIA

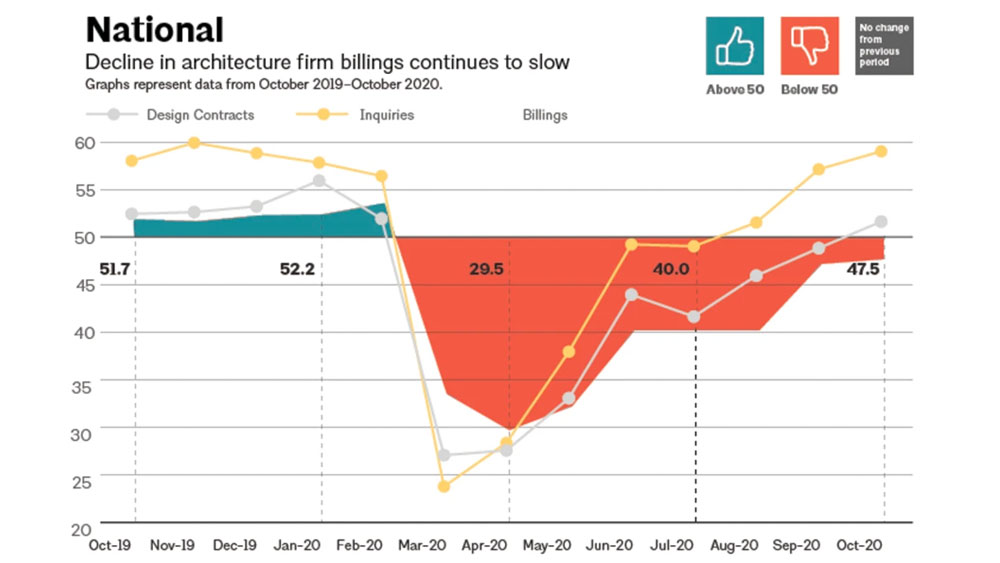

Looking at the national overview, we see a slow but positive trend in all areas. Inquiries continue to rise, and for the first month since February, we see design contracts rise above 50. With a slowly rising national average of 47.5, the billings index remains below 50 for the eighth consecutive month.

Image Credit: AIA

In broader economic news, October saw positive numbers in terms of non-farm employment, including 84,000 construction positions. Architectural services, which reports employment numbers one month behind overall employment, added 2,500 positions during September. Between August and September, the industry has been able to recapture 5,600 of the 5,900 jobs lost during July. The third quarter GDP is currently reporting an increase of 33.1%, compared to the steep decline of 31.4% during the second quarter.

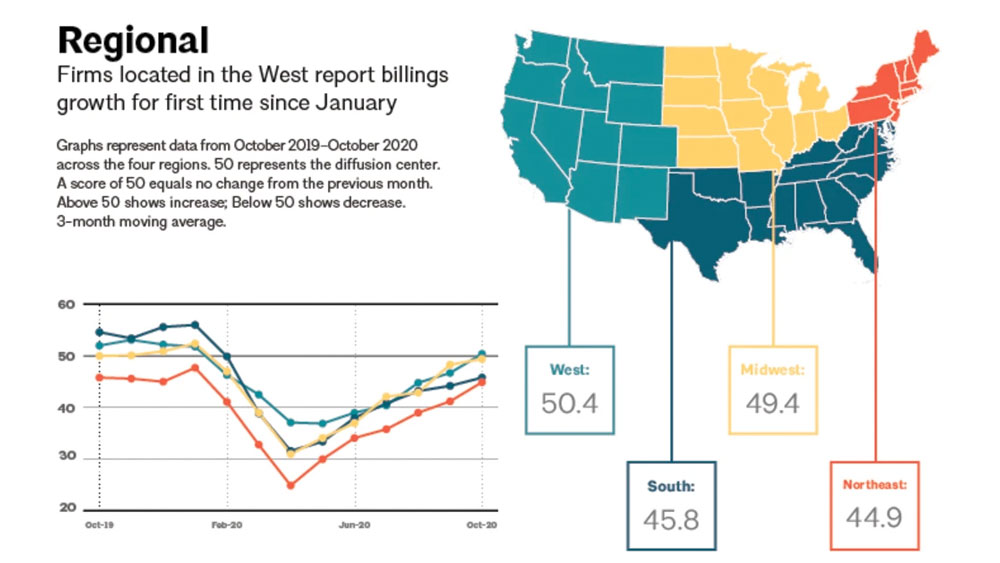

Comparing the October and September ABI scores for the four regions of the U.S., the Northeast continues to decline at 44.9, 3.8 points above the previous month. The Midwest gained 3.8 points as well, with a score of 49.4. The South only rose to 45.8, gaining only 2.1 points from the September index. The West is the big winner in October at 50.4, as it is the first region to reflect growth since February 2020.

Image Credit: AIA

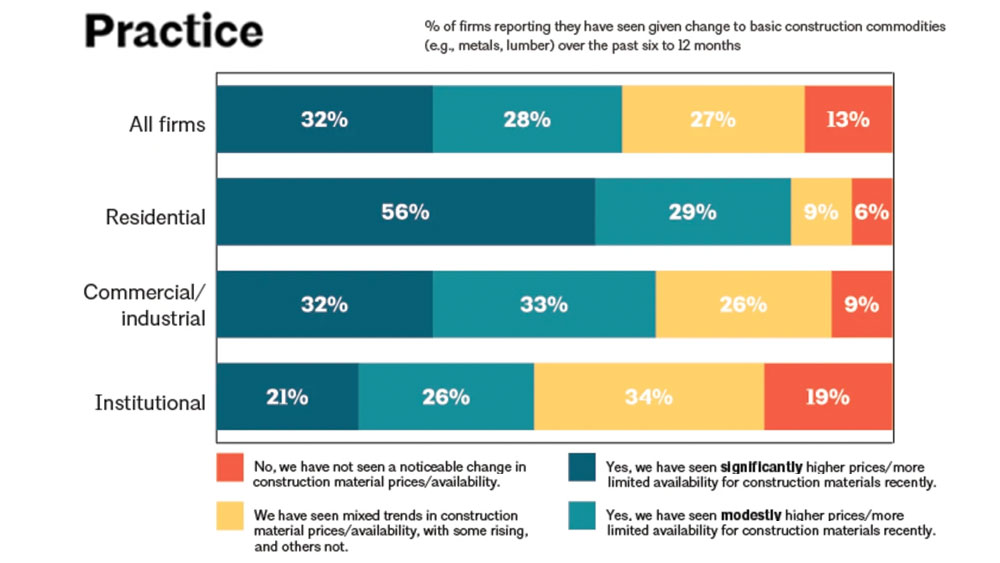

The October special practice questions from the AIA focused on the availability and cost of construction materials, and how these conditions may impact new or ongoing projects. Not surprisingly, 91% of respondents said the cost and/or availability of construction materials has become a "somewhat serious problem", with 15% stating it was a "very serious problem". According to the Associated General Contractors of America, commercial construction costs have risen by 30% since the onset of the COVID-19 pandemic. Although overall costs of construction have increased, it should be noted that only certain materials have seen a bump in price. For instance, in the last 12 months the cost of lumber and plywood has increased 26.7%, and concrete blocks and bricks have risen 3.6%. However, certain materials, like aluminum mill shapes and steel pipes, have seen a measurable price decrease of 9.8% and 5.6%, respectively. So even though the construction industry is seeing a high demand for limited products coupled with higher prices on common building materials, the somewhat stable or decreasing price of alternative products could provide a pathway to moving a project forward.

Image Credit: AIA

The industry is looking up, even if it is from the bottom of a well. The October 2020 ABI report shows that it may be a slow recovery, but it is coming. Each month the numbers inch closer to growth. Navigating around hard to find or budget-busting construction materials will be yet another hurdle on our way to attaining pre-pandemic billings growth. Perhaps this hurdle will be the push the U.S. needs to branch out more readily to steel and other lumber alternatives.